- Analytics

- News and Tools

- Market News

- Asian session: Dollar heads the weekly decline

Asian session: Dollar heads the weekly decline

The dollar headed for its biggest weekly drop against the yen in three months after Standard & Poor’s became the second ratings company this week to say it may cut the U.S.’s top credit grade.

The euro strengthened as Italian lawmakers prepared for a confidence vote on an austerity package and before the release of stress tests on European banks.

The European Banking Authority will release the results of the stress tests for 91 banks as part of an effort to reassure investors the region’s banks have sufficient capital.

The greenback headed for a second weekly loss against the Swiss franc as S&P said there’s at least a 50% chance it will cut the AAA rating within 90 days if it concludes Congress and President Barack Obama’s administration haven’t achieved a credible solution to the rising government debt burden.

Moody’s Investors Service put the U.S. Aaa credit rating on review for a downgrade on July 13, citing concern officials won’t raise the nation’s $14.3 trillion debt limit in time to prevent a missed payment.

“Uncertainty about the credit rating and debt-ceiling talk will continue weighing on the dollar,” said Toshiya Yamauchi, a senior currency analyst at Ueda Harlow Ltd.. “The market has a negative view for the dollar.”

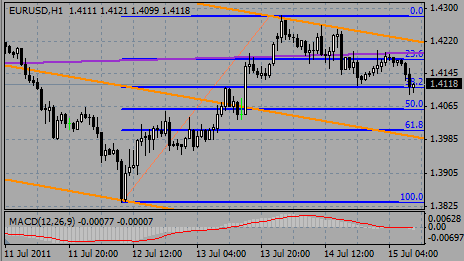

EUR/USD printed highs on $1.4190 before retreated to $1.4110.

GBP/USD retreated from $1.6170 to $1.6120.

USD/JPY rose from Y78.90 to Y79.20.

Today's focus in Europe will be on EU Trade balance.

In US investors will digest US CPI for June at 12:30 GMT. The same time NY Fed Empire State manufacturing index comes.

At 13:15 GMT US Industrial production will be released.

At 13:55 preliminary Michigan sentiment index is due to come.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.