- Analytics

- News and Tools

- Market News

- Asian session: The euro is under pressure

Asian session: The euro is under pressure

01:30 Australia Employment Change s.a. (Jun) 23.4K

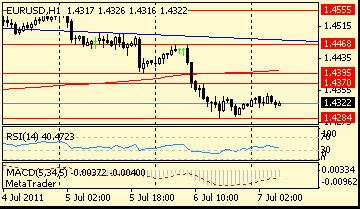

The euro traded near the lowest level in a week against the Swiss franc after analysts said Ireland’s credit rating may be cut to junk by Moody’s Investors Service following Portugal’s loss of its investment-grade rating.

The euro snapped yesterday’s loss against the dollar and yen after Moody’s said it differentiates “significantly” among European periphery countries, suggesting it may not imminently cut Ireland’s rating to junk in line with Portugal and Greece.

The European Central Bank will increase its main refinancing rate to 1.50 percent today from 1.25 percent, according to all economists in a survey. The central bank may increase borrowing costs further in the fourth quarter, according to a separate survey.

European data starts at 1000GMT by German in industrial output data. At 1145GMT, the ECB decision is due, which will be followed at 1230GMT

by the usual press conference with ECB President Jean-Claude Trichet.

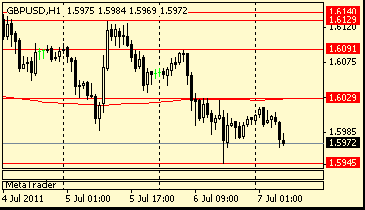

UK data includes at 0830GMT Industrial Production/Manufacturing Output data is due for release. The data is expected to show a bit of a rebound from the previous month, with industrial production rising 1.3% m/m but remaining lower by a reading of -0.4% y/y. Manufacturing output is seen

up 1.1% m/m, 2.2% y/y. The Bank of England Monetary Policy Committee makes it's announcement at 1100GMT but no change is expected in either

the current 0.50% overnight rate or the 200 billion level of asset purchases.

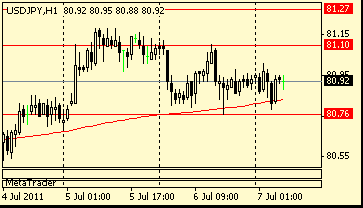

At 1215GMT, the ADP National Employment Report is due. Last month the unexpectedly soft reading caused some to revise their estimates

lower. The lackluster 54,000 increase in non-farm payrolls justified the revision. At 1230GMT, initial jobless claims are expecting toll to 420,000 in the July 2 week. Claims have been above 420,000 since the April 30 week. In the July 25 week, a labor analyst said there no special factors

contributing to the decline of 1,000 claims.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.