- Analytics

- News and Tools

- Market News

- FOREX: Tuesday's close

FOREX: Tuesday's close

Data released:

03:30 Australia RBA meeting announcement 4.75% 4.75% 4.75%

07:45 Italy PMI services (June) 47.4 49.4 50.1

07:50 France PMI services (June) 56.1 56.7 62.5

07:55 Germany PMI services (June) seasonally adjusted 56.7 58.3 56.1

08:00 EU(17) PMI services (June) 53.7 54.2 56.0

08:30 UK CIPS services index (June) 53.9 53.5 53.8

09:00 EU(17) Retail sales (May) adjusted -1.1% -1.0% 0.9%

09:00 EU(17) Retail sales (May) adjusted Y/Y -1.9% -0.6% 1.1%

12:55 USA Redbook (02.07)

14:00 USA Factory orders (May) 0.8% 1.0% -0.9 (-1.2)%

The US currency advanced Tuesday on speculation China’s efforts to tame inflation will cool growth and damp demand for riskier assets.

The euro dropped for the first time in seven days versus the greenback after Moody’s Investors Service said banks rolling over Greek bonds into new securities may incur impairment charges.

The pound strengthened against the euro and the dollar after a report showed a measure of U.K. service PMI exceeded economists’ forecasts in June

A gauge of U.K. services growth based on a survey of companies rose to 53.9 from 53.8 in May. The median forecast was for a decline to 53.5.

The pound has slumped this year as Conservative Prime Minister David Cameron’s austerity measures to shrink the budget deficit crimp growth and inflation squeezes incomes at the fastest pace since the 1970s. Efforts to eliminate the bulk of the fiscal shortfall by 2015 involve the deepest spending cuts since World War II and more than 300,000 state-employee job losses.

The Bank of England will keep its main rate unchanged at 0.5% on July 7. Investors are betting the central bank won’t raise borrowing costs until after next May.

The Australian dollar weakened against the greenback after the South Pacific nation’s central bank left borrowing costs unchanged. The Reserve Bank of Australia kept its cash rate target at 4.75% for a seventh straight meeting as signs of slower growth from Europe to China dimmed prospects for an acceleration in hiring at home.

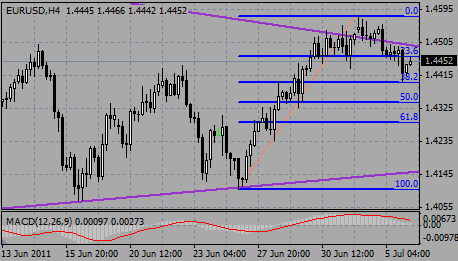

EUR/USD fell to $1.4400 after long-lasting consolidation between $1.4460/00.

GBP/USD rose sharply from session lows around $1.5990 to $1.6030 before retreated to $1.6035.

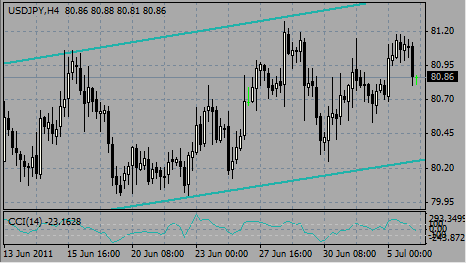

USD/JPY rose from Y80.70 to Y81.30 before set stable around Y80.90/20.

In Europe today's focus will be on final EU GDP (Q1) reading with no changes expected (09:00 GMT). Later (at 10:00 GMT) Germany is due to report on manufacturing orders for May.

US data start at 14:00 GMT with ISM Non-mfg PMI for June.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.