- Analytics

- News and Tools

- Market News

- Forex: Thursday's review

Forex: Thursday's review

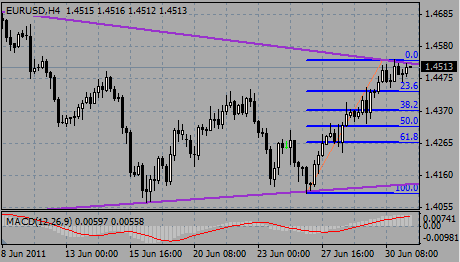

The euro climbed to the highest in almost three weeks against the dollar on prospects the European Central Bank will increase interest rates next week to curb inflation and as European ministers are set to approve the next aid payment due to Greece.

The case for higher rates was strengthened as data showed European consumer-price growth was above the ECB’s 2% target for a seventh month. The inflation rate remained at an initially estimated 2.7% for a second month in June, statistics showed today.

A separate report showed German unemployment declined for a 24th straight month in June.

Greek Prime Minister George Papandreou won approval of a second bill to authorize his 78 billion-euro ($113 billion) package of budget cuts and asset sales, a key to receiving further international financial aid.

German banks have agreed to roll over about 2 billion euros in the Greek bonds they’re holding that mature through 2014, German Finance Minister Wolfgang Schaeuble said.

ECB President Trichet repeated that policy makers are in a state of “strong vigilance” ahead of the July 7 meeting, a phrase he has used before tightening monetary policy in the past.

The pound slid to the least in more than 15 months against the euro as reports showed U.K. consumer confidence fell this month. Moreover, the house prices were little changed, limiting the scope for interest-rate increases.

The average cost of a home was 168,205 pounds ($270,255), compared with 167,208 pounds in May, when it rose 0.3%.

Consumer confidence fell to minus 25 from minus 21 last month, GfK NOP said in a separate report, below the minus 24 median estimate.

Bank of England policy maker Adam Posen on June 27 dismissed a call by the Bank for International Settlements for tighter monetary policy worldwide to curb inflation as “nonsense”.

EUR/USD recovered to $1.4540 following the decline to $1.4445. But later rate corrected to $1.4500.

GBP/USD initially fell to $1.5970 from $1.6110. Later pound back to $1.6100.

USD/JPY sharply rose from Y80.25 to Y80.86 before rate retreated to Y80.40.

Today's focus will be on PMI reports from France, Germany, EMU and UK.

In US today's attention will be on final reading of Michigan sentiment index, ISM Mfg PMI and Construction spending.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.