- Analytics

- News and Tools

- Market News

- Forex: Tuesday's review

Forex: Tuesday's review

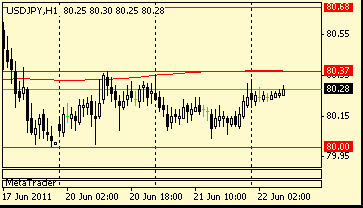

The dollar fell as stocks and commodities rose, reducing demand for a refuge as the Federal Reserve begins a two-day policy meeting.

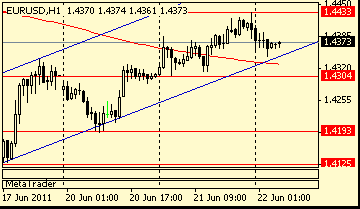

The greenback weakened to the lowest versus the euro in almost a week. The shared currency rose as European leaders said a Greek default can be avoided amid speculation Prime Minister George Papandreou will win a confidence vote today.

The euro rose as Greece’s Papandreou seeks to secure multiparty support for his government’s austerity measures. That is a condition for receiving aid needed to avoid a default.

Greece needs parliamentary approval of a 78 billion-euro ($112 billion) package of budget cuts and asset sales.

The greenback remained weaker as National Association of Realtors data showed sales of existing homes decreased in May to the lowest level in six months. Purchases of existing U.S. homes fell 3.8% to a 4.81 million annual pace last month, in line with estimates.

Meanwhile, economists forecast the Federal Open Market Committee will keep the benchmark interest rate at zero to 0.25 percent tomorrow, where it’s been since December 2008.

Australia’s dollar declined after the nation’s central bank said domestic data had not added “any urgency” to the need for policy adjustment and it may be “prudent” to keep rates unchanged, according to minutes released today of a June 7 policy meeting.

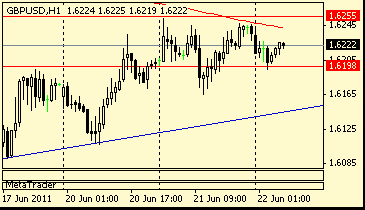

The pound weakened as Bank of England Markets Director Paul Fisher said further bond purchases to stimulate the economy are possible.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.