- Analytics

- News and Tools

- Market News

- EU session review: Euro weakens on delayed agreement for Greek bailout

EU session review: Euro weakens on delayed agreement for Greek bailout

Data released:

06:00 Germany PPI (May) 0.0% 0.1% 1.0%

06:00 Germany PPI (May) Y/Y 6.1% - 6.4%

08:00 EU(17) Current account (April) adjusted, bln -5.1 - -3.0 (-4.7)

The euro remains under pressure after European governments failed to agree on releasing a loan payment to spare Greece from default on its debts.

“The euro is still very vulnerable due to the uncertainty about the outlook for Greece,” said Niels Christensen, chief currency strategist at Nordea Bank AB. “The risk is that the euro-dollar moves back down to around $1.40 by the end of this week.”

Papandreou kicked off a three-day debate yesterday on a confidence motion in his government. He called for the vote last week after opposition parties rejected pleas for national consensus and the prime minister’s handling of the crisis led to defections from his party. Antonis Samaras, leader of New Democracy, the largest opposition party in Greece, repeated his call for elections.

Greece needs approval of a 78 billion-euro package of budget cuts to ensure the payment of a fifth loan under last year’s 110 billion-euro bailout. Euro-area finance ministers pushed Greece to pass laws to cut the deficit and sell state assets, and left open whether the country will get the full 12 billion euros promised for next month.

EUR/USD recovered to $1.4256 after it tested bids on $1.4100/90. But it failed to set above. Euro retreated to $1.4220.

GBP/USD continues to hold around session highs on $1.6180 after it challenged lows around $1.6106.

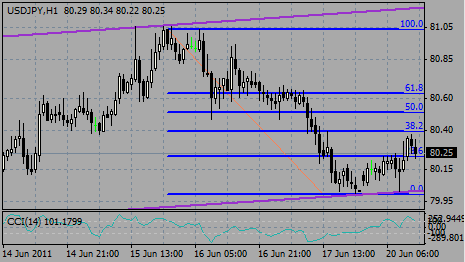

USD/JPY fell to Y80.00 before it was back to Y80.38 and remains above the figure.

There is no major data for today.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.