- Analytics

- News and Tools

- Market News

- EU session review: Euro declines on concern Europe debt crisis is worsening

EU session review: Euro declines on concern Europe debt crisis is worsening

Data released:

07:30 Swiss SNB press-conference 0.00-0.75% 0.00-0.75% 0.00-0.75%

08:30 UK Retail sales (May) -1.4% -0.5% 1.1%

08:30 UK Retail sales (May) Y/Y 0.2% 1.6% 2.8%

09:00 EU(17) Harmonized CPI (May) final 0.0% 0.0% 0.6%

09:00 EU(17) Harmonized CPI (May) final Y/Y 2.7% 2.7% 2.8%

09:00 EU(17) Harmonized CPI ex EFAT (May) Y/Y 1.5% 1.6% 1.6%

The euro weakened to a three-week low against the dollar and slid versus the yen as speculation the Greek debt crisis is deteriorating damped demand for the region’s assets.

The euro fell for a second day after Dutch newspaper Het Financieele Dagblad cited European Central Bank Governing Council member Nout Wellink as saying the region’s emergency fund should be doubled, and was also dragged lower on concern a reshuffling of Greek Prime Minister George Papandreou’s cabinet will lead to a renegotiation of aid terms.

“The market is still quite concerned about Greece,” said Matthew Brady at JPMorgan Chase & Co.. “It’s going to be a choppy ride for the euro. There’s no doubt about that. I’d prefer to still sell any rallies in euro.”

German Chancellor Angela Merkel and French President Nicolas Sarkozy will meet tomorrow in Berlin, with pressure increasing for the leaders to reach an accord on a rescue package for Greece.

New Zealand’s dollar weakened after Finance Minister Bill English said the currency’s strength was hurting the economy.

The Swiss franc appreciated as the central bank kept its main interest rate at 0.25%.

EUR/USD failed to break above strong resistance at $1.4200, spurring porition adjustment. Rate fell to $1.4092. Later euro tries to recover, but was capped at $1.4160 and fell to a new lows around $1.4074.

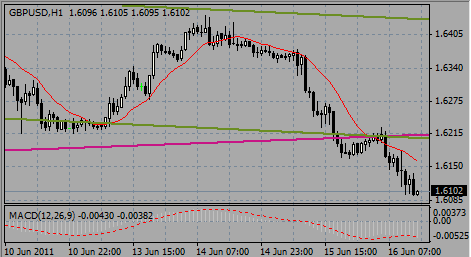

GBP/USD fell after a weak UK rateil sales data from $1.6227 to $1.6094.

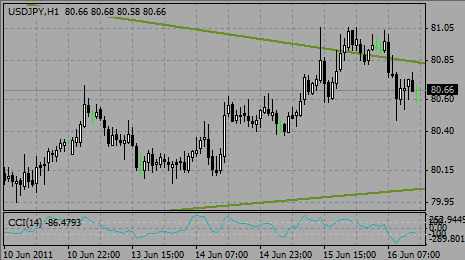

USD/JPY weakened from Y81.00 to Y80.50 before rose back to Y80.60/70.

US data starts at 1230GMT with the weekly Jobless Claims as well as current account and Housing Starts, Building Permits data. Initial jobless claims are expected to fall 7,000 to 420,000 in the June 11 week, while the pace of housing starts is expected to rise to 547,000 after falling 10.6% in April. Home building remains very weak as homes

sales are still below year ago levels. This is followed at 1400GMT the Philadelphia Fed index is expected to rise to a reading of 9.0 in June sharp declines in April and May.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.