- Analytics

- News and Tools

- Market News

- Forex: Wednesday's review

Forex: Wednesday's review

The single currency suffered after rating agency Moody’s warned it could downgrade three French banks. Moody’s said it would review the ratings of BNP Paribas, France’s largest bank, and peers Société Générale and Crédit Agricole, focusing on their holdings of Greek public and private debt.

The move came amid continued wrangling between eurozone finance minister and central bankers over who should bear the cost of a fresh rescue package for Greece.

German Chancellor Angela Merkel and French President Nicolas Sarkozy will meet on June 17 in Berlin, with pressure mounting for the leaders to resolve their differences over a rescue for Greece.

The euro remained weaker after strong US CPI report for May and a measure of manufacturing in the New York region unexpectedly shrank in June.

The consumer-price index increased 0.2 percent, compared with the 0.1 percent median forecast of economists. The core measure, which excludes more volatile food and energy costs, climbed 0.3 percent, the biggest increase since July 2008.

The Federal Reserve Bank of New York’s general economic index dropped to minus 7.8, the lowest level since November, from 11.9 in May. The median forecast was 12.

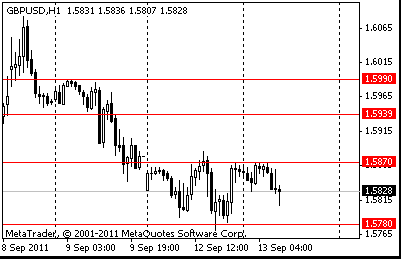

Sterling fell versus the dollar after a report showed Britain’s jobless claims rose in May at its fastest pace in almost two years in May.

So, U.K.’s jobless claims rose by 19,600 in May after a revised 16,900 increase in the prior month. The median forecast was for an increase of 6,500.

UK data at 0830GMT includes SMMT Car Production as well as Retail Sales for May.

sales are still below year ago levels. This is followed at 1400GMT the Philadelphia Fed index is expected to rise to a reading of 9.0 in June sharp declines in April and May.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.