- Analytics

- News and Tools

- Market News

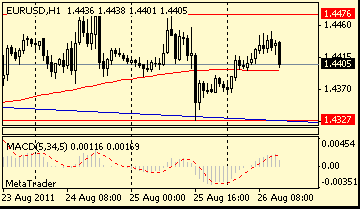

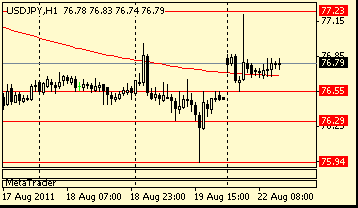

- Asian session: The euro fell

Asian session: The euro fell

Data:

UK labour market data is due at 0830GMT and is expected to show a 5k change in the claimant count with the rate at 4.6%. Average weekly earnings are expected to come in at 2.1%. The ILO measures are expected to show a -38k jobless change and a 7.7% rate. In London tonight, the Bank of England Governor Mervyn King delivers what is traditionally seen as his keynote annual address at the Mansion House.

14.0 in June after falling in May. The US Treasury International Capital System (TICS) data is due at 1300GMT, shortly followed at 1315GMT by industrial production, which is expected to rise 0.2% in May after a flat reading in April that resulted from a shortage of motor vehicle parts from Japan. Stocks data at 1430GMT.US data then continues with the weekly EIA Crude Oil

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.