- Analytics

- News and Tools

- Market News

- EU session review: Yen, Dollar falls after China reports

EU session review: Yen, Dollar falls after China reports

Data released:

08:30 UK HICP (May) 0.2% 0.2% 1.0%

08:30 UK HICP (May) Y/Y 4.5% 4.5% 4.5%

08:30 UK HICP ex EFAT (May) Y/Y 3.3% 3.4% 3.7%

08:30 UK Retail prices (May) 0.3% 0.4% 0.8%

08:30 UK Retail prices (May) Y/Y 5.2% 5.3% 5.2%

08:30 UK RPI-X (May) Y/Y 5.3% 5.3% 5.3%

The yen, the dollar and the Swiss franc fell against most of their major counterparts after reports showed China’s retail sales and industrial production increased, sapping demand for the safest currencies.

The U.S. currency declined against the euro for a second day before data that may show retail sales fell.

“Fears about a global slowdown seem to have been calmed by the improved industrial production data out of China,” said Bjarke Roed-Frederiksen, an analyst at Nordea Markets.

China’s statistics bureau said retail sales rose 16.9% last month, while industrial production increased more than economists projected. The 5.5% acceleration in China’s consumer-price index was in line with economists’ forecasts.

The Bank of Japan today kept the benchmark overnight rate unchanged in a range between zero percent and 0.1%.

EUR/USD failed to hold above session high on $1.4470 and retreated to $1.4420. Later rate tries to recover and rose to $1.4453.

GBP/USD fell from session high on $1.6440 to lows around $1.6375. Currently rate holds around $1.6396.

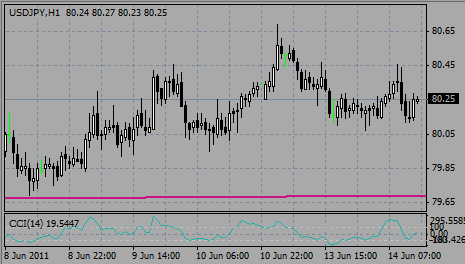

USD/JPY weakened after challenging Y80.50. Rate fell to the lows near Y80.06. In general, rate trades tight.

The dollar also fell amid signs U.S. growth is slowing. Retail sales declined 0.5% in May, the first drop since June, according to a survey of economists. The producer-price index rose 0.1 percent in May after a 0.8 percent increase in April, another survey showed before today’s data.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.