- Analytics

- News and Tools

- Market News

- Forex: Monday's review

Forex: Monday's review

The euro slid to a record low versus the Swiss franc as concern increased that European leaders may not be able to find common ground on a Greek bailout.

European Central Bank President Jean-Claude Trichet and German Finance Minister Wolfgang Schaeuble are at odds about whether Greek bondholders should be compelled to incur losses in the nation’s second bailout in 14 months.

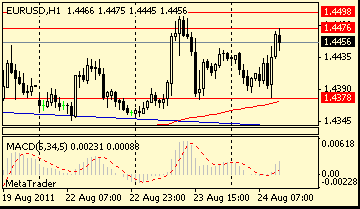

The dollar dropped against most of its counterparts before a report this week forecast to show U.S. retail sales declined in May. Retail sales in the U.S. fell 0.5% in May, the first drop since June. The Commerce Department will release the report June 14.

Luxembourg’s Prime Minister Jean-Claude Juncker, who leads the group of euro-area finance ministers, said that any bailout for Greece must include “voluntary” investor participation. Juncker is trying to bridge the gap between Germany’s Schaeuble, who wants Greek bondholders to accept longer maturities of up to seven years on the debt, and Trichet, who said imposing losses on creditors would be akin to a default.

New Zealand’s dollar fell after its second-biggest city was struck by aftershocks of the February earthquake.

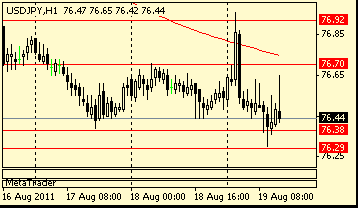

The yen weakened versus most of its major peers after a report showed Japan’s factory orders declined 3.3% in April from March, when they rose 1%, the Cabinet Office said today.

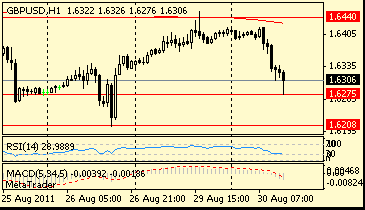

It is a busy week for UK data, starting at 0830GMT today with inflation data for May. CPI looks set to continue at levels well over double the BOE's 2% target through into early 2012. Expected hikes in house hold energy tariffs will boost CPI up to annual rates close to 5% from the late summer.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.