- Analytics

- News and Tools

- Market News

- Forex: Thursday's review

Forex: Thursday's review

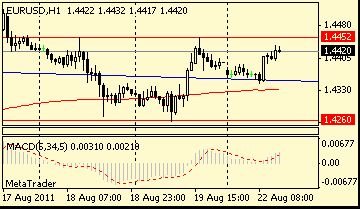

The euro fell, erasing earlier gains, after European Central Bank President Jean-Claude Trichet’s 2012 inflation forecast prompted traders to scale back bets for the pace of interest-rate increases.

The shared European currency slid against the dollar after climbing as much as 0.5 percent, even after Trichet said at a press conference in Frankfurt that “strong vigilance” is needed to contain inflation, which means policy makers may boost rates in July. The ECB revised its 2012 inflation and gross domestic product forecasts.

The ECB said inflation next year will accelerate between 1.1 percent and 2.3 percent, compared with an earlier forecast of 1 percent to 2.4 percent. Policy makers see growth in 2012 of 0.6 percent to 2.8 percent, from a previous range of 0.8 percent to 2.8 percent.

The common currency also declined amid renewed concern that Greece may need to restructure its debt.

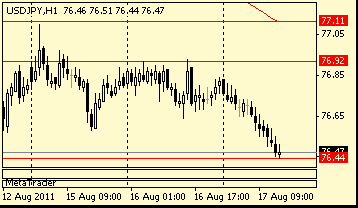

The Dollar Index rose today as the U.S. trade deficit unexpectedly shrank 6.7 percent to $43.7 billion in April, Commerce Department figures showed today.

New Zealand’s currency climbed to a record after the nation’s central bank said borrowing costs will need to rise in the next two years.

The Bank of England kept its benchmark rate unchanged at 0.5 percent at today’s meeting.

UK data includes industrial production and PPI at 08:30 GMT.

At 0900GMT, the Bundesbank is due to the publish bi-annual German economic outlook repor.

US data starts at 1230GMT with the May-11 Import/Export Price Index. At 1800GMT, the U.S. Treasury is expected to post a $140.0 billion budget gap in May, compared with the $135.9 billion gap in May 2010.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.