- Analytics

- News and Tools

- Market News

- Forex: Wednesday's review

Forex: Wednesday's review

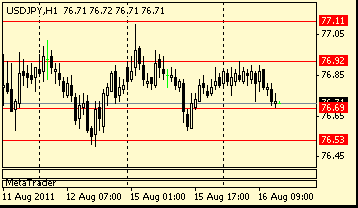

The yen strengthened as global stocks fell and the International Monetary Fund said its 26 billion-euro ($38 billion) loan to Portugal “entails important risks.”

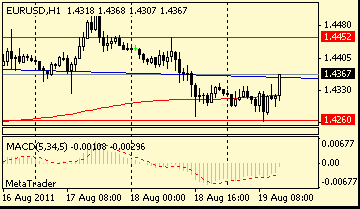

The euro slid from a four-week high versus the dollar after German Finance Minister Wolfgang Schaeuble said bondholders must contribute a “substantial” share of a second aid package for Greece.

The yen rose to the strongest in a month against the dollar as Federal Reserve Chairman Ben S. Bernanke said the “frustratingly slow” U.S. recovery warrants sustained monetary stimulus.

New York Fed President William Dudley said that the U.S. recovery from the worst financial crisis since the Great Depression is “distinctly subpar” even after “aggressive monetary and fiscal stimulus.”

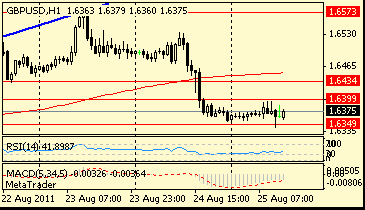

The pound fell against the dollar and the euro after Moody’s Investors Service said the U.K. risks losing its top credit ranking should growth remain weak. It said the outlook on the country’s rating is “stable.”

Fed's Beige book: Econ activity generally continued to expand.

UK data at 0830GMT includes the trade data, where the total trade balance is expected to come in at -stg2.9 billion with global goods at -stg7.6 billion and the non-EU total trade balance at -stg4.3 billion. The Bank of England policy decision is due at 1100GMT but with UK data showing the momentum of the recovery fading fast through the first two months of Q2, analysts and markets are putting off their expectation for the first rate hike until November at the earliest.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.