- Analytics

- News and Tools

- Market News

- Forex: Monday's review

Forex: Monday's review

The euro weakened for the first time in three days Monday against the dollar on concern euro-area leaders will struggle to resolve the debt crisis, damping demand for the region’s assets.

The shared currency weakened after Greek Prime Minister George Papandreou said he’ll press ahead with additional austerity measures even as he failed to win backing from opposition parties.

Greece’s Antonis Samaras, leader of the biggest opposition party, New Democracy, rejected Papandreou’s plan at a meeting with him and other opposition leaders in Athens, saying his party wouldn’t be blackmailed.

European Union officials have called for consensus on the package, which includes an extra 6 billion euros ($8.6 billion) of budget cuts and a plan to speed 50 billion euros of state-asset sales.

New Zealand has recorded its biggest monthly trade surplus on the back of higher prices for dairy products, the country’s top export earner, in a positive sign for a nation hit hard by two recent earthquakes and years of weak economic growth.

The NZ$1.11bn ($908m) trade surplus for April was nearly double economists’ forecasts and helped push the New Zealand dollar to its highest level against its US counterpart since the currency was floated in 1985.

Fonterra, the dairy farmer’s co-operative that accounts for about a fifth of the nation’s exports, recently said that March was its best month for export volumes thanks to rising demand from China, south-east Asia and the Middle East.

Strengthening trade links with China have also helped drive the record trade surplus. Exports to China have risen by nearly 40% in the 12 months ended in March.

New Zealand’s gross domestic product rose 0.2% in the final quarter of 2010 compared with the three months ended September.

However, the devastation caused by February’s earthquake in Christchurch, the second seismic event within six months, is expected to see the economy shrink by about 0.2% in the three months ended in March.

Nevertheless, the economy is expected to strengthen as 2011 continues with growth of about 1.3% for the year, rising to 3.7% in 2012.

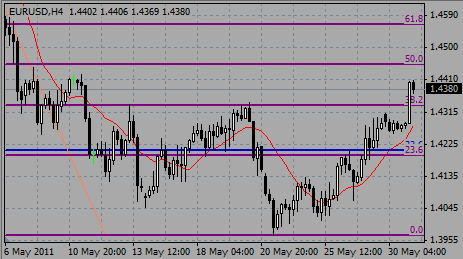

EUR/USD fell from Asian high on $1.4305 to the lows near $1.4255 before recovered a bit to current $1.4284. Resistance between $1.4285/90 capped the bulls' attemps to break above.

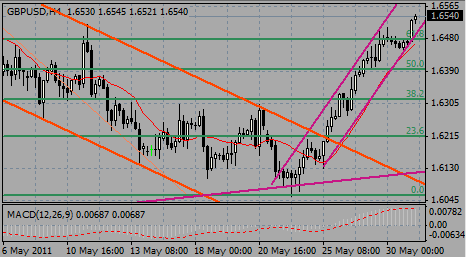

GBP/USD was under pressure, thus above support at $1.6460/50.

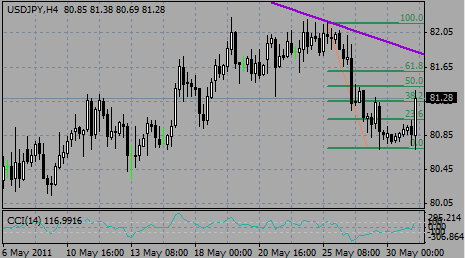

USD/JPY held within the Y80.75/90 before tested Y81.00.

Today's main event is Bank of Canada's rate decision at 13:00 GMT before Chicago PMI is due to come at 14:00 GMT.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.