- Analytics

- News and Tools

- Market News

- EU session review: Euro weakens on concern Europe will struggle debts

EU session review: Euro weakens on concern Europe will struggle debts

The euro weakened for the first time in three days against the dollar on concern euro-area leaders will struggle to resolve the debt crisis, damping demand for the region’s assets.

The shared currency weakened after Greek Prime Minister George Papandreou said he’ll press ahead with additional austerity measures even as he failed to win backing from opposition parties.

“There’s still a lot of uncertainty about the possibility of a Greek restructuring and what is going to be done to help it refinance itself,” said You-na Park, a currency strategist at Commerzbank AG. “That’s driving the euro weaker.”

Greece’s Antonis Samaras, leader of the biggest opposition party, New Democracy, rejected Papandreou’s plan at a meeting with him and other opposition leaders in Athens, saying his party wouldn’t be blackmailed.

European Union officials have called for consensus on the package, which includes an extra 6 billion euros ($8.6 billion) of budget cuts and a plan to speed 50 billion euros of state-asset sales.

“There are definitely still peripheral European problems,” said Osao Iizuka at Sumitomo Trust & Banking Co.. “The uncertainty is likely to weigh on the euro.”

The euro has fallen 2.1% in the past month.

The Swiss franc has strengthened 3.8% and the yen has added 2.4%.

Demand for New Zealand’s dollar was bolstered after the nation’s statistics bureau said today that exports outpaced imports by NZ$1.11 billion ($910 million) from a revised NZ$578 million surplus in March. The median estimate was for a NZ$600 million surplus.

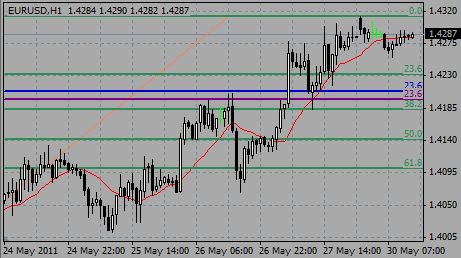

EUR/USD back to $1.4284 after earlier it weakened to $1.4255. Resistance remains between $1.4285/90.

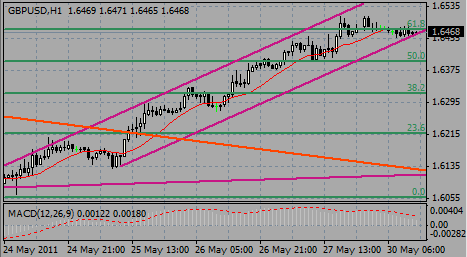

GBP/USD continues to holds under pressure, thus above support at $1.6460/50. Stops noted through $1.6445/40 with further support noted into $1.6430.

USD/JPY still holds within the Y80.75/90.

U.S. markets are closed today for the Memorial Day holiday.

Markets in the U.K. are also closed to observe the Spring Bank Holiday.

Among the figures from Canada investors may digest GDP and Trdae Balance data at 12:30 GMT.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.