- Analytics

- News and Tools

- Market News

- EU session review: Dollar falls for second day on signs U.S. growth is slowing

EU session review: Dollar falls for second day on signs U.S. growth is slowing

Data released:

06:00 UK Nationwide house price index (May) 0.3% 0.1% -0.2%

06:00 UK Nationwide house price index (May) Y/Y -1.2% -1.7% -1.3%

08:00 EU(17) M3 money supply (April) adjusted Y/Y 2.0% 2.3% 2.3%

08:00 EU(17) M3 money supply (3 months to April) adjusted Y/Y 2.1% 2.3% 2.0%

09:00 EU(17) Economic sentiment index (May) 105.5 105.8 106.2

09:00 EU(17) Business climate indicator (May) 0.99 1.20 1.28

The dollar weakened for a second day against the euro and the yen before reports that economists said will show U.S. consumer spending slowed in April and pending home sales declined.

The yen declined against the European common currency as Japan had its credit outlook revised down by Fitch Ratings.

“The market is more concerned about the U.S. than it is about Europe,” said Sonja Marten, a currency strategist at DZ Bank AG. “We have weak growth in the U.S. When you look at the debt situation in the euro zone as a whole, it’s much better than in the U.S. More importantly, they’re doing something about it.”

The euro headed for a weekly loss versus the franc and the yen. A European Commission report today showed an index of executive and consumer sentiment in the region slid to 105.5 this month from 106.2 in April. The median estimate of economists was 105.7.

Luxembourg Prime Minister Jean-Claude Juncker said yesterday the International Monetary Fund may not release its share of a 12 billion-euro aid package to Greece next month.

EUR/USD rose to $1.4280 before rate corrected to $1.4230. Next attenpt to gain ground failed to break the session higha and euro weakened to $1.4185. Later rate recovered to $1.4244.

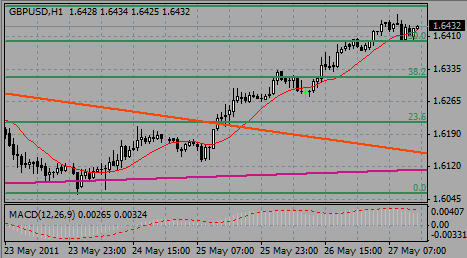

GBP/USD printed session high on $1.6460 before set stable around $1.6400/40.

USD/JPY broke channel support line from May 05 at Y81.20 and showed lows near Y80.80.

US data starts at 1230GMT with the personal income report that is expected to rise 0.4% in April. Growth in U.S. consumer spending slowed to 0.5 percent in April, the smallest gain in three months, according to a survey.

At 1355GMT, the Michigan Sentiment Index is expected to be unrevised at a reading of 72.4 in May.

At 1400GMT release of NAR Pending Home Sales is scheduled.

Pending home sales fell 1% in April, economists predict the National Association of Realtors will say today.

“All things considered, the weak fundamental data should provide a ‘sell dollars’ environment,” Sacha Tihanyi, a senior currency strategist at Scotia Capital.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.