- Analytics

- News and Tools

- Market News

- EU session review: Euro rises after German IFO

EU session review: Euro rises after German IFO

Data released:

06:00 Germany GDP (Q1) revised 1.5% 1.5% 1.5%

06:00 Germany GDP (Q1) revised Y/Y 4.9% 4.9% 4.9%

06:45 France Business confidence (May) 107 109 109 (110)

08:00 Germany IFO business climate index (May) 114.2 110.0 114.2 (110.4)

08:30 UK PSNCR (April), bln 3.3 2.0 24.8

08:30 UK PSNB (April), bln 7.7 5.0 16.4

09:00 EU(17) Industrial orders (April) -1.8% -1.0% 0.5 (0.9)%

09:00 EU(17) Industrial orders (April) Y/Y 14.1% 12.9% 21.5 (21.3)%

11:30 UK CBI retail sales volume balance (May) 18% 12% 21%

The euro rose against the dollar as German business confidence unexpectedly stayed near a record in May, fueling bets that the European Central Bank will resume raising interest rates even as the debt crisis intensifies.

The Ifo institute said its business climate index held at 114.2 from April after economists forecast a decline to 113.7.

Europe’s common currency has dropped about 6% from its 2011 high against the dollar on May 4, amid concern that Greece may have to restructure its debt.

A restructuring would be a “horror story” that the central bank cannot accept, ECB Governing Council member Christian Noyer told reporters today.

The euro pared gains against the yen as a report showed European industrial orders declined more than economists forecast in March. Orders in the euro area slipped 1.8% from February, when they increased 0.5%. Economists had forecast a drop of 1.1%.

The pound fell versus the euro after Moody’s Investors Service placed U.K. financial institutions on review for downgrades and Britain posted a larger budget deficit than predicted.

Lloyds Banking Group Plc (LLOY) and Royal Bank of Scotland Group Plc are among 14 U.K. lenders whose debt Moody’s is considering downgrading as withdrawal of government support may increase their credit risk. The outlook on Barclays Plc (BARC)’s senior debt and deposit ratings was changed to negative from stable, Moody’s said in a statement today.

Britain had net borrowing of 10 billion pounds ($16 billion) last month, the largest for any April since at least 1993, data showed today. The median of forecasts was for a shortfall of 6.5 billion pound.

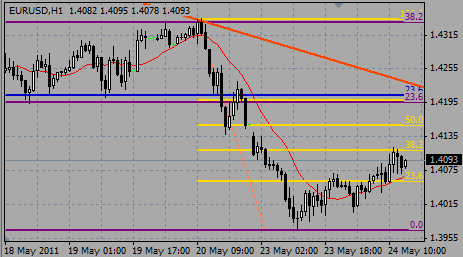

EUR/USD tested highs on $1.4115, but failed to hold above the figure and retreated to $1.4070. But decline was weak and there is a room for a second test of highs.

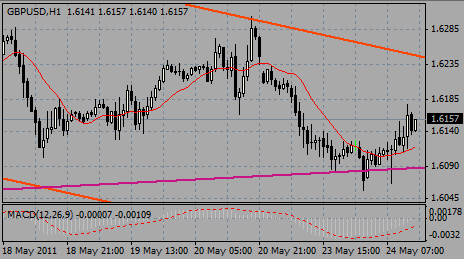

GBP/USD tested $1.6180 after the release of stronger than forecast CBI data, but the report fails to prompt any further rally and rate retreats. Back under $1.6140 to open a deeper move toward $1.6120/15 ahead of $1.6105/00.

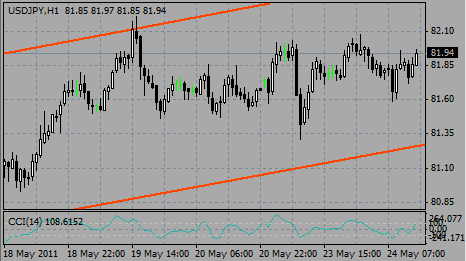

USD/JPY challenges Y82.00, correcting from Asian lows around Y81.60.

US data come at 1400GMT with report on New home sales.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.