- Analytics

- News and Tools

- Market News

- EU focus: Dollar rallies on EU debt problems

EU focus: Dollar rallies on EU debt problems

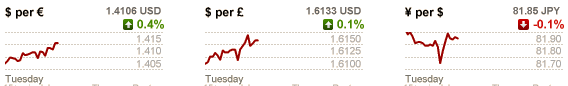

The dollar held firm near a seven-week high against a basket of currencies and the euro remained on the defensive on Tuesday amid worries that the euro zone's debt crisis could spread to countries like Spain.

Standard & Poor's cut its outlook for Italy to "negative" from "stable" on Saturday, while a crushing defeat for Spain's ruling socialists in local elections raised worries about Prime Minister Jose Luiz Rodrigo Zapatero's ability to meet fiscal targets.

But euro buying from Asian central banks helped stem the euro's decline, with some traders saying that in the near-term there might be a small rebound for the single currency.

"The amount of the euro selling in the past few days has been huge. So I suspect a lot of euro long positions have been cleared. Some may be probably caught in short positions," said a trader at a U.S. bank. "I expect the euro to rebound in the near term, though I still think it's still in a downtrend in the longer run," he said.

The euro has also been suffering from a lack of consensus among European policy-makers on how to deal with Greece, as many opposed the idea of debt restructuring while some market players think it is inevitable.

As worries about the euro zone's debt problems spread, other European currencies also came under pressure. The pound slipped to an eight-week low before erasing gains.

The Swiss currency was hurt by comments from Swiss National Bank Vice Chairman Thomas Jordan that he is "very worried" about the rise in the franc and that the bank will take action if deflationary pressure emerges as a result of a higher franc.

But the New Zealand dollar gained after a quarterly survey on behalf of the Reserve Bank of New Zealand (RBNZ) showed inflation expectations in New Zealand rose in the second quarter.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.