- Analytics

- News and Tools

- Market News

- EU session review: Dollar advances as commodities, stock markets decline

EU session review: Dollar advances as commodities, stock markets decline

Data released:

08:30 UK Industrial production (March) 0.3% 0.7% -1.2%

08:30 UK Industrial production (March) Y/Y 0.7% 1.2% 2.4%

08:30 UK Manufacturing output (March) 0.2% 0.3% 0.0%

08:30 UK Manufacturing output (March) Y/Y 2.7% 2.8% 4.9%

09:00 EU(17) Industrial production (March) -0.2% 0.4% 0.6 (0.4)%

09:00 EU(17) Industrial production (March) Y/Y 5.3% 6.3% 7.7 (7.3)%

The dollar strengthened against the majority of its most actively traded peers as commodity prices and stocks slumped.

The Dollar Index, which tracks the greenback against the currencies of six major U.S. trading partners, climbed to the highest in three weeks as the Stoxx Europe 600 slid 1.1%, following a decline in U.S. and Asian equities.

The euro fluctuated between gains and losses versus the dollar amid speculation Greece may have to restructure debt.

The pound fell against the dollar after a report showed manufacturing rose less than estimated, giving the Bank of England leeway to hold its main interest rate at a record low for longer to spur growth.

Sterling also declined against the Japanese yen and retreated from a seven-week high against the euro. Manufacturing output rose 0.2% in March from the month before, the Office for National Statistics said today, below the 0.3% median estimate. A separate release showed industrial production rose 0.3% from February, less than the 0.8% survey forecast.

EUR/USD failed to hold around daily highs on $1.4230 and retreated to $1.4177. Attemps to go back to highs were short-lived and euro fell to $1.4120. Currently rate recovers, holding around $1.4177.

GBP/USD fell sfter the weak UK data from $1.6380 to the lows around $1.6250. Rate currently trades at $1.6277.

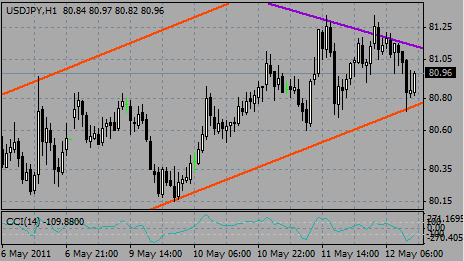

USD/JPY weakened from Y81.30 to Y80.70. Currently rate holds around Y81.00 - at Y80.95.

Retail sales probably climbed in April, showing growing employment is enabling Americans to withstand higher costs for groceries and gasoline, economists said before a report today. The projected 0.6% gain in purchases would follow a 0.4% March increase, according to the median forecast of economists.

The Commerce Department’s sales figures are due at 12:30 GMT. Economists’ estimates ranged from gains of 0.2% to 1.2%.

The Labor Department will also issue two reports at 12:30 GMT. One may show jobless claims fell by 44,000 to 430,000 last week.

The other may show producer prices rose 0.6% in April after increasing 0.7% the prior month.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.