- Analytics

- News and Tools

- Market News

- US Q1 GDP preliminary data are due to come at 12:30 GMT with median of +0.5% m/m and +1.8% y/y

US Q1 GDP preliminary data are due to come at 12:30 GMT with median of +0.5% m/m and +1.8% y/y

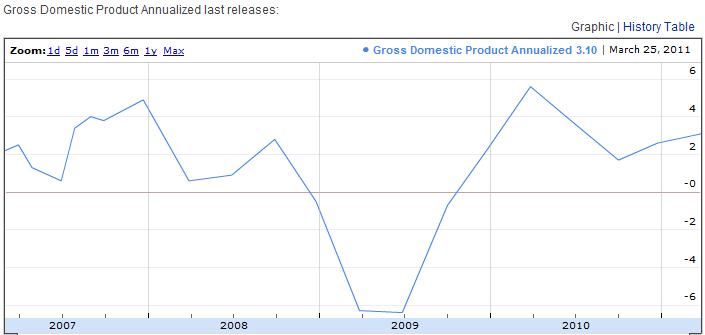

Median estimate for the first publication of GDP for Q1 is +1.8% y/y after +3.1% in Q2, wit promising employment numbers on the one hand and underlying weakness in the housing market on the other that has led a number of prominent institutions to downgrade their economic growth forecasts for Q1 and 2011 as a whole.

As a reminder, yesterday Bernanke said in the press conference that he believes GDP growth will be less than 2% as slower consumer spending and a wider trade deficit slowered economic activity at the start of the year.

Possible outcome:

Above estimates: A strong reading above 1.8% should give the USD some strength to correct the selling pressure. Data should ideally breach the psichological 2% band, this could trigger a strong rebound in the Dollar, aiming to set under $1.4800. Below this achievable break, not much support is seen until $1.4700, stronger support, ahead of $1.4650.

Below estimates: Should the number fall short of 1.8%, then the Dollar is poised to extend gains towards the next area of resistance at $1.4900. Upon the touch of this new high, the doors for $1.5000 big round number will get widely opened. From a weekly perspective, the chart does not show much resistance until $1.5120/30 area.

In line with expectations: Data in line with estimates may not be good enough for the Dollar. However, Euro may find it hard to overstrech much further. For these reasons, we favour quotes to consolidate near highs with the potential to see a pullback to $1.4700.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.