- Analytics

- News and Tools

- Market News

- EU session review: Dollar index declines to lowest since 2008

EU session review: Dollar index declines to lowest since 2008

Data released:

06:00 Germany Import prices (March) 1.1% 1.1% 1.1%

06:00 Germany Import prices (March) Y/Y 11.3% 11.3% 11.9%

06:00 Germany Import prices excluding oil (March) Y/Y - 8.8%

06:45 France Consumer spending (March) -0.7% 0.3% 0.9%

06:45 France Consumer spending (March) Y/Y 2.6% 3.7% 5.5%

07:55 Germany Unemployment (April) seasonally adjusted -37K -32K -55K

07:55 Germany Unemployment (April) seasonally adjusted, mln - -

07:55 Germany Unemployment rate (April) seasonally adjusted 7.1% 7.0% 7.1%

The Dollar Index fell to its lowest level since 2008 as the Federal Reserve’s pledge to keep interest rates near zero to stimulate growth spurred investors to buy higher-yielding assets.

The Australian dollar climbed to a record against its U.S. counterpart amid speculation the South Pacific nation will raise rates to contain inflation.

“It’s still a broadly negative dollar story,” said Lee Hardman, a currency strategist at Bank of Tokyo-Mitsubishi UFJ Ltd.. “There’s not much change to the outlook for Fed policy. The downtrend for aggressive dollar selling is firmly entrenched.”

The dollar has lost 1.1% in the past week, extending this year’s decline to 6.9%. The yen has fallen 0.9% this week, and has lost 7.6% this year.

The Dollar Index fell for an eighth day, its longest losing run since March 2009, after Fed Chairman Ben S. Bernanke signaled yesterday in his first press conference following a policy decision that the central bank intends to maintain monetary stimulus.

Fed policy makers kept the target rate for overnight lending between banks at zero to 0.25%. The rate has remained at that level since December 2008.

Australia’s dollar appreciated as traders boosted bets that the central bank will increase borrowing costs. The Reserve Bank of Australia will raise its target rate of 4.75% by 25 basis points over the next 12 months, up from 19 basis points a week earlier.

EUR/USD corrected to $1.4795 before it rose to 17-months highs around $1.4880 earlier.

GBP/USD back to $1.6660 after rising up to highs near $1.6740.

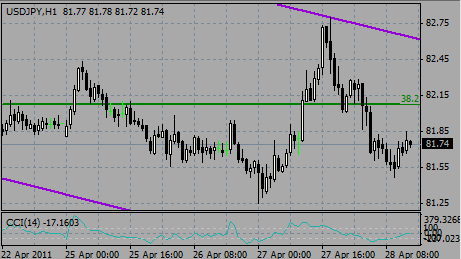

USD/JPY fell to a session low on Y81.50 before back to Y81.82.

In the US, also at 1230GMT, the main release is the Q1 US GDP data and the April 23 week jobless claims data. The advance estimate for first quarter GDP is expected to be at a 1.8% rate of growth, down from the 3.1% gain in the previous quarter.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.