- Analytics

- News and Tools

- Market News

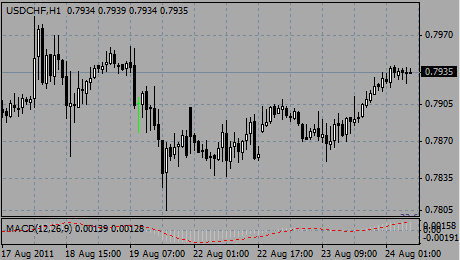

- EU session review: Dollar falls ahead of FOMC

EU session review: Dollar falls ahead of FOMC

Data released:

10:00 UK CBI industrial order books balance (April) -11% +3% +5%

10:00 UK CBI industrial output balance (April) 22% - 27%

The dollar fell against the yen and dropped against the franc on speculation the Federal Reserve will discuss measures to keep yields low to support the economy.

Fed policy makers, who begin a two-day meeting today, may consider measures to support the economy as the end of its $600 billion asset-purchase program approaches in June.

“The Federal Reserve is likely to remain cautious and stress that loose monetary policy will be in place in the foreseeable future,” said Lee Hardman, a currency strategist at Bank of Tokyo-Mitsubishi UFJ Ltd.

“We expect the Fed will leave its policy rate on hold,” said Mike Jones, a currency strategist at Bank of New Zealand Ltd. “Should Chairman Ben S. Bernanke indicate the Fed is in no hurry to start reversing policy accommodation, further dollar weakness may be on the cards.”

The U.S. central bank will leave its target rate for overnight lending between banks at zero to 0.25 percent at its two-day meeting starting today, according to another survey. The Fed may say it plans to complete the purchase of $600 billion of Treasuries by June.

EUR/USD rose to a new 2011 highs on $1.4652 before Trichet's comments dragged the rate down to $1.4600/05.

GBP/USD gained to session highs on $1.6533 before retreated to $1.6468.

USD/JPY holds within the narrow range between Y81.55/80.

The S&P/Case-Shiller index of home prices in 20 U.S. cities for the 12 months through February fell 3.3%, the biggest decline since November 2009, according to a survey of economists.

US consumer confidence at 1400GMT the highlights though seen overshadowed by Wednesday's FOMC.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.