- Analytics

- News and Tools

- Market News

- EU session review: Euro Declines for Second Day on Greece, Finland

EU session review: Euro Declines for Second Day on Greece, Finland

The euro fell for a second day against the dollar on speculation Greece will be unable to avoid a default, even after officials said debt restructuring isn’t being discussed.

The single currency declined to a two-week low versus the yen on concern election gains by Finland’s euro-skeptic bloc will hinder regional efforts to assist ailing nations, including Portugal and Ireland.

Greek bond yields surged to records.

“The latest developments in the euro region have a potential to provide hurdles for the euro,” said Jane Foley, a senior currency strategist at Rabobank International. “The situation in Finland has to be monitored very closely, because it’s reflecting a trend in the political landscape of the region. There’s clearly fear among voters that they have to pay for fiscal mistakes of others.”

Greece found support from IMF Managing Director Dominique Strauss-Kahn and French Finance Minister Christine Lagarde after German Finance Minister Wolfgang Schaeuble was quoted as saying “further measures may have to be taken” if Greece fails an audit in June.

New Zealand’s dollar dropped against all of its major counterparts as data showed consumer prices rose less than forecast. New Zealand’s consumer prices rose 0.8% in the first quarter from three months earlier, the government said today. Economists forecast a 1% gain.

EUR/USD tries to recover, but reached $1.4390 only before was dragged down to a fresh session lows around $1.4265.

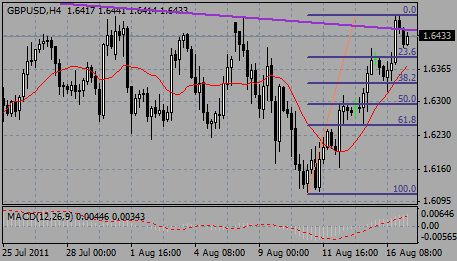

GBP/USD fell from $1.6310 to $1.6240. Later rate recovered to $1.6270.

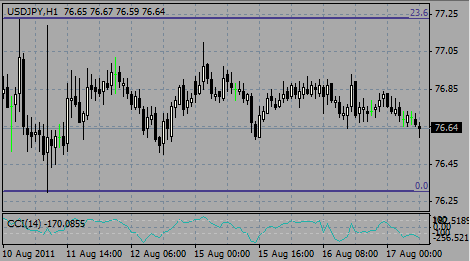

USD/JPY printed lows around Y82.60 before it was back to Y82.90.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.