- Analytics

- News and Tools

- Market News

- EU session review: Euro drops

EU session review: Euro drops

The euro tumbled on concern Europe’s most indebted nations including Greece may be forced to reorganize their debt payments to bondholders.

The euro weakened against the dollar, yen, Swiss franc and pound.

The Japanese currency strengthened after German Finance Minister Wolfgang Schaeuble told Die Welt newspaper that Greece may need to negotiate with creditors should an audit in June question its ability to make debt repayments. Portuguese and Greek bonds slumped, driving yields to record highs.

“The comments from Schaeuble are critical and represent a change in view that some form of debt restructuring cannot be ruled out,” said Michael Derks, head of currency strategy at FXPro Financial Services. “There seems to be a greater focus on these peripheral issues and that’s dragging the single currency down.”

The New Zealand dollar strengthened to a five-month high against the greenback after demand rose at a NZ$700 million ($556 million) auction of government bonds.

Australia’s dollar reversed earlier losses as Asian stocks advanced, boosting demand for higher-yielding assets.

Australia’s dollar weakened earlier after leaders of the so-called BRICS nations said rising commodity prices posed a threat to global growth and the Monetary Authority of Singapore stepped up its fight against inflation.

EUR/USD initially rose to the highs on $1.4480, but Schaeuble's comments dragged the rate down to session lows around $1.4362. Later rate recovered to $1.4395.

GBP/USD printed session lows near $1.6300 - at $1.6285 before back to $1.6335.

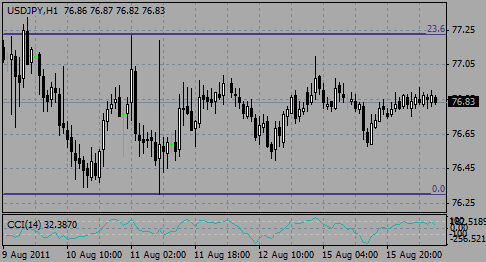

USD/JPY weakened from Y83.80 to Y83.00. rate failed to break the figure that spurred the retreat to Y83.16.

The Labor Department is scheduled to release its latest reports on first-time unemployment claims and producer prices for March at 1230 GMT. Analysts expect initial claims to have edged higher by 3,000 to 385,000 claims last week, while producer prices are expected to have risen 1.1% in March.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.