- Analytics

- News and Tools

- Market News

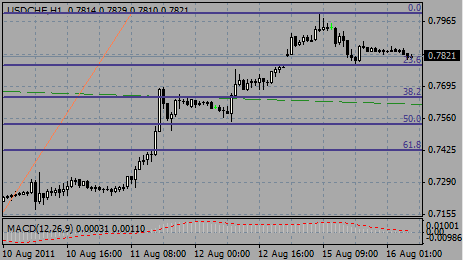

- EU focus: Dollar hits fresh 16-month low

EU focus: Dollar hits fresh 16-month low

The dollar hit a fresh 16-month low against a basket of currencies on Thursday as expectations grew the Federal Reserve would keep its loose monetary policy, widening interest rate differentials in favour of higher-yielding currencies.

The tone for the dollar remained weak after Wednesday's U.S. retail sales data and the Fed's Beige Book report did nothing to change the view the central bank would keep its $600 billion asset buying programme until June.

In contrast, the European Central Bank is expected to follow up its April interest rate hike with more tightening later this year, a factor keeping the single currency near a 15-month peak against the dollar.

The dollar index fell to 74.676, bringing its losses this year to around 5%.

"The fact that the U.S. recovery is continuing will not become a trigger point for Fed policy," said Masafumi Yamamoto, chief FX strategist at Barclays Capital.

"Unemployment, although improving, is still relatively high and the Fed is not going to bring forward the end of its loose monetary policy. The dollar is finding no fresh factors to rise on."

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.