- Analytics

- News and Tools

- Market News

- Forex: Wednesday's review

Forex: Wednesday's review

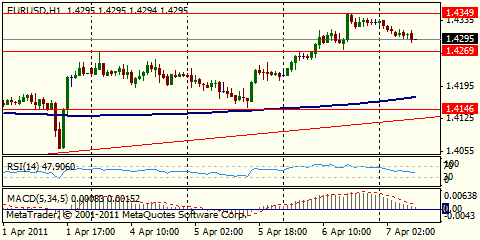

The euro rallied to its highest level against the dollar in more than 14 months on speculation the European Central Bank will increase borrowing costs further after raising its target lending rate tomorrow.

ECB President Jean-Claude Trichet signaled on March 3 that policy makers may raise the benchmark rate at their next meeting to curb inflation, which reached a two-year high of 2.6 percent last month.

The ECB will raise its main rate by 25 basis points from a record low 1 percent tomorrow, according to economists.

Europe’s currency has gained 6.9 percent against the dollar this year as stronger economic growth in Germany and accelerating inflation boosted expectations that policy makers in the 17-member bloc will need to raise interest rates even as nations including Ireland and Portugal struggle to contain debt.

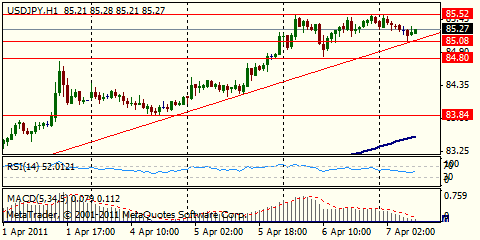

The yen tumbled against all of its major counterparts on bets the Bank of Japan will keep interest rates low as the nation recovers from the earthquake and tsunami while borrowing costs in other developed nations rise. The dollar slid against most of its peers while advancing to a six-month high versus the yen on the view that the Federal Reserve will trail other central banks in ending economic stimulus except the BOJ.

The Swiss franc gained versus most of its major counterparts, rising 0.8 percent to 91.77 centimes versus the dollar, as inflation unexpectedly accelerated in March.

Consumer prices increased 1 percent from a year earlier, the Federal Statistics Office reported. The median forecast of economists was for a 0.5 percent annual pace, the same as in the previous month.

German industrial output data is due at 10:00 GMT. This is followed at 1145GMT by the policy decision from the European Central Bank with the usual press conference led by ECB President Trichet starting from 1230GMT.

previous week.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.