- Analytics

- News and Tools

- Market News

- Forex: Tusday's review

Forex: Tusday's review

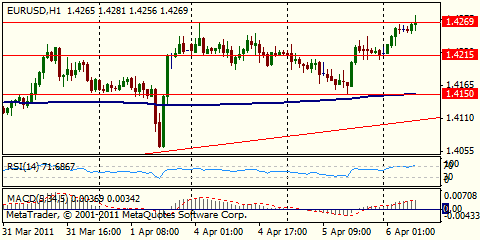

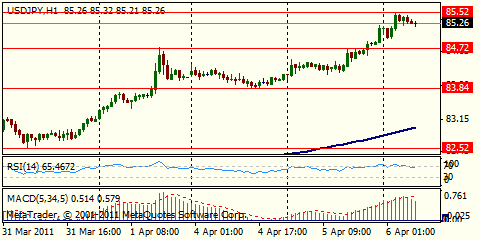

The dollar rose against the yen after Federal Reserve Chairman Ben S. Bernanke said yesterday inflation must be watched “extremely closely,” spurring bets interest rates may be raised sooner than forecast.

Australia’s dollar dropped from almost a record after the Reserve Bank of Australia Governor Glenn Stevens held the overnight cash target rate at 4.75 percent for a fourth straight meeting as floods disrupted coal mining in the nation’s northeast and a rising currency tempered inflation.

FOMC said: "To mitigate (infl) risks... agreed that FOMC would continue its planning for the eventual exit from the current, exceptionally accommodative stance of monetary policy. In light of uncertainty about the economic outlook, it was seen as prudent to consider possible exit strategies for a range of potential economic outcomes. A few participants indicated that economic conditions might warrant a move toward less-accommodative monetary policy this year; a few others noted that exceptional policy accommodation could be appropriate beyond 2011." Also, "A few members noted that evidence of a stronger recovery, or of higher inflation or rising infl expectations, could make it appropriate to reduce the pace or overall size of the purchase program. Several others indicated that they did not anticipate making adjustments to the program before its intended completion."

Recall that staff forecasts were rev down for growth, up for inflation.

UK data: at 0830GMT with UK industrial production and manufacturing output data. IP is expected to come slow slightly to +0.4% m/m, 4.3% y/y with manufacturing at 0.6% m/m, 5.8% y/y.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.