- Analytics

- News and Tools

- Market News

- EU session review: Euro retreats from 4-month high before ECB decision

EU session review: Euro retreats from 4-month high before ECB decision

Data released:

07:00 Germany Retail sales (January) real adjusted 1.4% 0.3% -0.3%

07:00 Germany Retail sales (January) real unadjusted Y/Y 2.6% 1.7% -1.3%

08:45 Italy PMI services (February) 53.1 51.1 49.9

08:50 France PMI services (February) 59.7 60.8 57.8

08:55 Germany PMI services (February) seasonally adjusted 58.6 59.5 60.3

09:00 EU(17) PMI services (February) 56.8 57.2 55.9

09:00 Italy PPI (January) 1.1% 0.9% 0.6%

09:00 Italy PPI (January) Y/Y 5.1% 4.6% 4.6%

09:30 UK CIPS services index (February) 56.2 54.2 54.5

10:00 EU(17) Retail sales (January) adjusted 0.4% 0.2% -0.4 (-0.6)%

10:00 EU(17) Retail sales (January) adjusted Y/Y 0.7% 0.3% -0.9%

10:00 EU(16) GDP (Q4) revised 0.3% 0.3% 0.3%

10:00 EU(16) GDP (Q4) revised Y/Y 2.0% 2.0% 2.0%

The euro declined against the dollar, falling from its strongest level in almost four months, before the European Central Bank announces a decision on interest rates.

ECB policy makers will leave their main refinancing rate unchanged at a record low of 1%, according to all economists in a survey, while central bank President Jean-Claude Trichet may indicate future policy at a press conference that follows the decision.

The ECB, which aims to keep annual gains in consumer prices to just below 2%, will publish inflation projections for 2011 and 2012 today after its monthly policy meeting.

The franc erased a decline against the euro after Swiss central bank Vice Chairman Thomas Jordan said there is no need for intervention at the moment. Also he noted that Swiss franc at very strong level at the moment.

EUR/USD rose to $1.3880 before tested session lows around $1.3830. Rate failed to break above the resistance/offers at $1.3880 and retretaed to $1.3859.

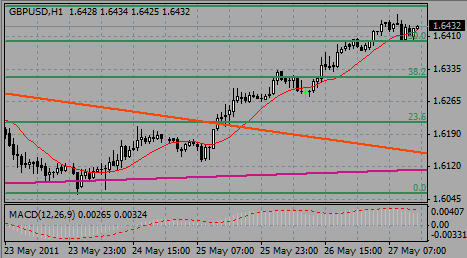

GBP/USD initially consolidated within the $1.6300/30 range before weakening to $1.6250.

USD/JPY remains within the Y81.70/90 range.

The main event of Thursday is set to be the European Central Bank meeting where the announcement is due at 1245GMT.

ECB President Trichet's press conference is at 1330GMT..

Jobless claims due to come at 13:30 GMT too.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.