- Analytics

- News and Tools

- Market News

- EU session review: Euro up; faltering risk appetite supports dollar

EU session review: Euro up; faltering risk appetite supports dollar

Data released

10:00 EU(17) PPI (January) 1.5% 0.9% 0.8%

10:00 EU(17) PPI (January) Y/Y 6.1% 5.5% 5.3%

The euro inched up on Wednesday, driven by expectations of higher official rates, although subdued risk appetite is likely to put a lid on gains and keep the dollar off a 3-1/2 month low versus a basket of currencies.

European Central Bank policymakers meet on Thursday, and with euro zone inflation well above its target, markets see the central bank sharpening its anti-inflation rhetoric.

But gains in the common currency risk a correction as geopolitical turmoil continues to fuel uncertainty and higher energy prices, causing stocks to tumble on Wednesday.

Concerns higher oil prices could hamper a global recovery are likely to erode investors' appetite for risk and drive them towards currencies like the U.S. dollar and Swiss franc, considered a safe-haven in times of stress.

"We have a deteriorating geopolitical situation which will see the U.S. dollar supported," said Ian Stannard, senior currency strategist at BNP Paribas.

Investors are nervous that the Middle-East crisis could spread, engulfing key oil producer Saudi Arabia, where financial markets have come under heavy selling pressure.

"Overall the risks for the euro are also rising, but ahead of the ECB meeting we expect it to be well supported," Stannard said. "But after the ECB meeting, we could see sovereign debt problems returning and that could see the euro under pressure."

The euro received a boost from data which showed euro zone producer prices rising in January at their highest rate in the history of the single currency, driven by energy costs. Despite this, the single currency has failed to clear the one-month high of $1.3857 it struck on Monday.

Economists say the ECB will hold fire on rates until at least October, but financial markets are betting on an earlier hike from the current record low of 1%.

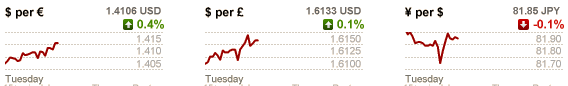

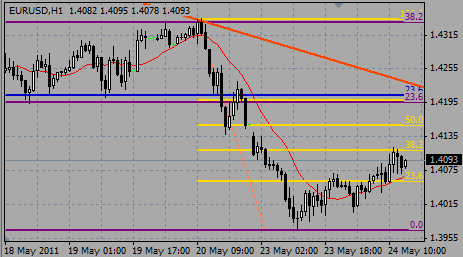

EUR/USD strongly rose from $1.3740 to $1.3842 before retreated a bit. Resistance comes at Monday's high on $1.3857.

GBP/USD rose after a strong Construntion CPI data. Rate gained from $1.6210 to $1.6322 before back off under $1.6300.

USD/JPY fell from Y82.10 before set stable within the Y81.80/00 range.

Analysts say further dollar gains will depend on U.S. data.

Data on Tuesday showed U.S. manufacturing grew in February at its fastest rate in nearly seven years. The data supported forecasts for a strong improvement in U.S. non-farm payrolls due on Friday, which could give the dollar a boost.

Analysts expect payrolls to rise by 185,000, after a tepid 36,000 rise in January.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.