- Analytics

- News and Tools

- Market News

- EU session review: Yen, Swiss Franc weaken

EU session review: Yen, Swiss Franc weaken

Data released

07:00 UK Nationwide house price index (February) 0.3% -0.2% -0.1%

07:00 UK Nationwide house price index (February) Y/Y -0.1% - -1.1%

08:45 Italy PMI (February) 59.0 57.6 56.6

08:50 France PMI (February) 55.7 55.3 54.9

08:55 Germany PMI (February) seasonally adjusted 62.7 62.6 60.5

08:55 Germany Unemployment (February) seasonally adjusted -52K -14K -13K

08:55 Germany Unemployment (February) seasonally adjusted, mln 3.069 - 3.135

08:55 Germany Unemployment rate (February) seasonally adjusted 7.3% 7.4% 7.4%

08:55 Germany Unemployment (February) seasonally unadjusted, mln 3.317 - 3.347

08:55 Germany Unemployment rate (February) seasonally unadjusted 7.9% - 8.0 (7.9)%

09:00 EU(17) PMI (February) 59.0 59.0 57.3

09:30 UK CIPS manufacturing index (February) 61.5 61.7 62.0

09:30 UK M4 money supply (January) final 0.8% - -1.3%

09:30 UK M4 money supply (January) final Y/Y -1.7% - -1.5%

09:30 UK Consumer credit (January), bln -0.3 0.2 0.8 (0.2)

10:00 Italy CPI (February) preliminary 0.3% 0.2% 0.4%

10:00 Italy CPI (February) preliminary Y/Y 2.4% 2.2% 2.1%

10:00 Italy HICP (February) preliminary Y/Y 2.1% 2.0% 1.9%

10:00 EU(17) Harmonized CPI (February) Y/Y preliminary 2.4% 2.4% 2.3%

10:00 EU(17) Unemployment (January) 9.9% 10.0% 10.0%

The yen and the Swiss franc weakened as economic reports from Japan to Sweden added to signs the global recovery is gathering pace, damping demand for safer assets.

Japan’s currency fell as the European Commission raised its growth forecast for 2011 and said inflation may stay above the European Central Bank’s limit for most of the year, boosting the appeal of higher-yielding securities.

The euro extended yesterday’s advance versus the franc amid speculation ECB President Jean-Claude Trichet will signal this week that policy makers are ready to raise interest rates.

Gross domestic product in the euro region may increase 1.6% this year, above an earlier forecast of 1.5% growth, the European Commission said today. Inflation will average 2.2%, the agency forecast, up from a November estimate of 1.8%. Inflation in the 17- nation bloc quickened to 2.4% last month from 2.3% in January, the European Union’s statistics office said today in a preliminary estimate.

Australia’s dollar climbed for a third day against the Japanese unit as a government report showed retail sales gained 0.4% in January from a month earlier. That beat the 0.3% median forecast in a survey.

EUR/USD printed session high on $1.3854, but failed to go further and retreated to $1.3823.

GBP/USD fell to $1.6255 after testing highs around $1.6323.

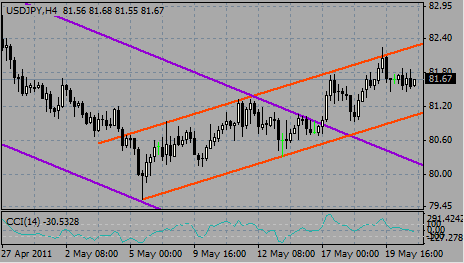

USD/JPY slowly weakened from Y82.25 to Y82.02.

US data starts at 1500GMT, when Federal Reserve Chairman Ben Bernanke gives his semi-annual monetary policy report to the Senate Banking Committee in Washington.

US data also heats up at 1500GMT, when ISM manufacturing data is expected to fall to 60.5 in February.

At the same time, construction spending is expected to fall 0.8% in January following the residential-related plunge in December. Housing starts rose sharply in the month, suggesting that residential construction rebound in the month.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.