- Analytics

- Market analysis

- Market Opinions

- EURUSD: where is the end of the decline?

EURUSD: where is the end of the decline?

I remember

as I conducted the seminar about the euro in May 2013 and I said that the euro

would decline although the euro was climbing. Some seminar participants disagreed

with me. One and half year later, I have never expected that the euro will

decrease in such pace.

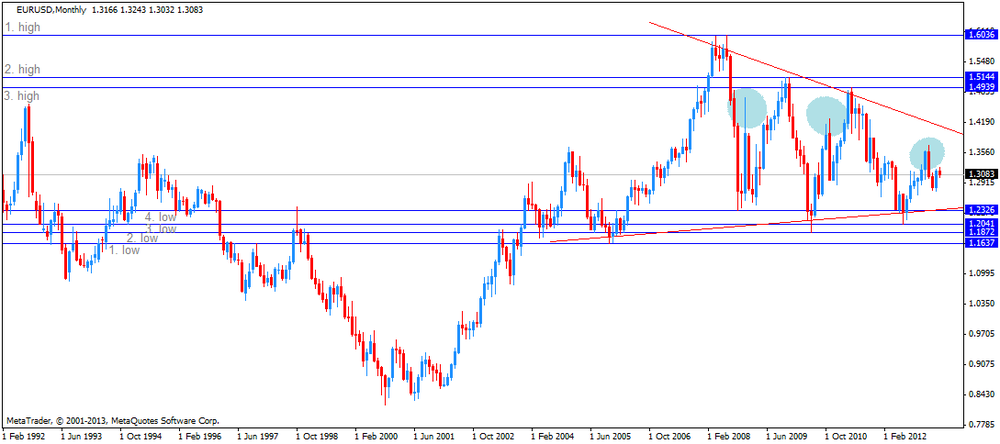

EURSUD

monthly, May 2013

The euro

has broken through the sufficient levels at 1.3000 and at 1.2744. It has last

only one month. In the meantime, Eurozone’s single currency fell to 1.2358.

There is a

question: where is the end of the decline?

From the

fundamental view, it doesn’t look well for the euro. The divergence between monetary

policies in Europe and the United States is getting bigger. The Fed has decided

to end its bond-buying program, but to keep unchanged its interest rates for a

"considerable time".

The European

Central Bank (ECB) is willing to add further stimulus measures. The ECB

President Mario Draghi said on November 17 that the central bank could purchase

government bonds.

The euro

dropped on last Friday after the ECB reiterated that the ECB is prepared to add

further stimulus measures if needed. Investors speculate that the central bank

is moving closer to launch the quantitative easing programme.

I think

that the level of EURUSD at some about 1.2000 is realistic.

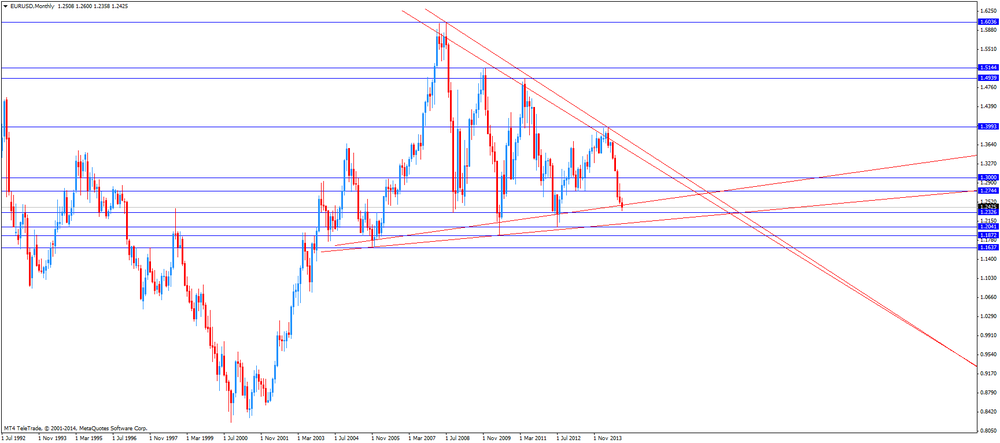

From the

technical view, the euro could decline toward the support level at 1.2326. Then

we could see a pullback to the level at 1.2744.

But there

is also a possibility that the euro will pull back from the support line at

about 1.2465 and we could see a pullback to the level at 1.2744.

EURSUD

monthly, November 20, 2013

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.